In recent years, the global electric vehicle market has undergone great changes. The market originally dominated by US electric vehicle giant Tesla has today become a multi-corner track. So far, Tesla is still regarded as the global leader in electric vehicles, but at a time when electric vehicle manufacturers in China and other countries are rapidly emerging, how is the global landscape of the electric vehicle market suddenly changing?

Recently, a report released by Morgan Stanley pointedly pointed out that today’s China may have caught up with Tesla in terms of electric vehicle hardware.

In addition to Chinese-funded electric vehicle BYD (BYD), even the newly added Xiaomi has begun to lead the trend of electric vehicles.

The rise of electric vehicles in China

In its recent analysis report, Morgan Stanley specifically mentioned the SU7 launched by Xiaomi, saying that this model is definitely a watershed.

This model, described as an “electric Ferrari”, is very popular. It evokes high-end design elements of the Ferrari Purosangue and Aston Martin DBX, but is priced close to Volkswagen Group’s ID.3 electric car or Tesla’s Model Y.

This fundamentally raises the competitive threshold for all market segments targeting US$30,000 to US$40,000 (approximately S$38,500 to S$51,400). Through this design and price strategy, Xiaomi is not only challenging Tesla, it is also setting a new benchmark for the global electric vehicle market.

Since the SU7 was launched in March 2024, deliveries of this electric vehicle have exceeded 258,000 units. Xiaomi’s “aggressive” pricing strategy has allowed it to emerge halfway and become a strong competitor in the electric vehicle market.

Xiaomi founder Lei Jun once publicly compared his YU7 with Tesla’s Model Y, claiming that his YU7 has a cruising range of 835 kilometers, which is longer than the Model Y’s 600 kilometers. Regarding this cruising range, even Ford Motor has publicly admitted that when Ford catches up in a few years, Xiaomi’s third-generation car is likely to push technology to another level.

The Morgan Stanley report pointed out that Xiaomi’s turnover of electric vehicles is expected to reach RMB 233 billion (approximately S$41.5 billion) by 2027. This rapid business expansion is unprecedented in the electric vehicle industry. This even seems to compress the timeline and milestones that traditional automakers can achieve in decades.

BYD sold a total of 7231 electric vehicles in the European market in April this year, which is higher than Tesla’s sales of 7165 electric vehicles. (Reuters)

From the perspective of the competitive landscape, the competitors that shake the global electric vehicle industry are not limited to Xiaomi.

BYD overtakes Tesla for the first time in Europe

Recently, BYD’s sales in the European electric vehicle market surpassed Tesla for the first time. In April this year, BYD sold a total of 7231 electric vehicles in the European market. Tesla sold 7165 electric vehicles in the same month. This seems to be an important turning point in the European electric vehicle market, as Tesla, which has long led the market, has been caught up.

Although the EU imposes tariffs on China electric vehicles, the overall market demand for China electric vehicles remains strong. Although European markets may try to ease this trend through tariffs, this new wave has already taken shape. This has also led some traditional automakers to explore joint ventures or technical cooperation with China technology companies in order to promote the development of electric vehicles more quickly and reduce capital expenditures.

Electric vehicle strategies across the West are changing accordingly.

For example, Volkswagen Group invested US$700 million (approximately S$900 million) in Chinese-funded XPeng Automobile, using XPeng Automobile’s technology and platform to cooperate to develop two Volkswagen brand electric vehicles for the China market. U.S. jeep manufacturer Stellantis also acquired about 20% of a stake in Zhejiang’s start-up electric vehicle company Leapmotor, and established a joint venture company Leapmotor International, which uses Stellantis’s distribution network to export and sell products from Zepmotor cars in major markets around the world.

The next battlefield is complete unmanned technology

If China is already ahead of the electric vehicle hardware race, then the next battlefield is complete Autonomous Driving.

Faced with rapid development, Tesla’s strategy needs to be adjusted and changed. Tesla’s strategy must shift from “the best electric vehicle” to “the best driverless software,” which is believed to be a direct counterattack by Tesla against the decline in its superior defense capabilities of traditional electric vehicles.

If it wants to maintain its king status, it cannot lose in this link.

Despite the “ambush on all sides”, Dan Ives, managing director of Wedbush Securities, is still quite optimistic about Tesla’s prospects. He even said in an analytical report published that Tesla is about to enter a “golden era.”

Tesla’s strategy must shift from “the best electric vehicle” to “the best driverless software,” which is believed to be a direct counterattack by Tesla against the decline in its superior defense capabilities of traditional electric vehicles. (Reuters)

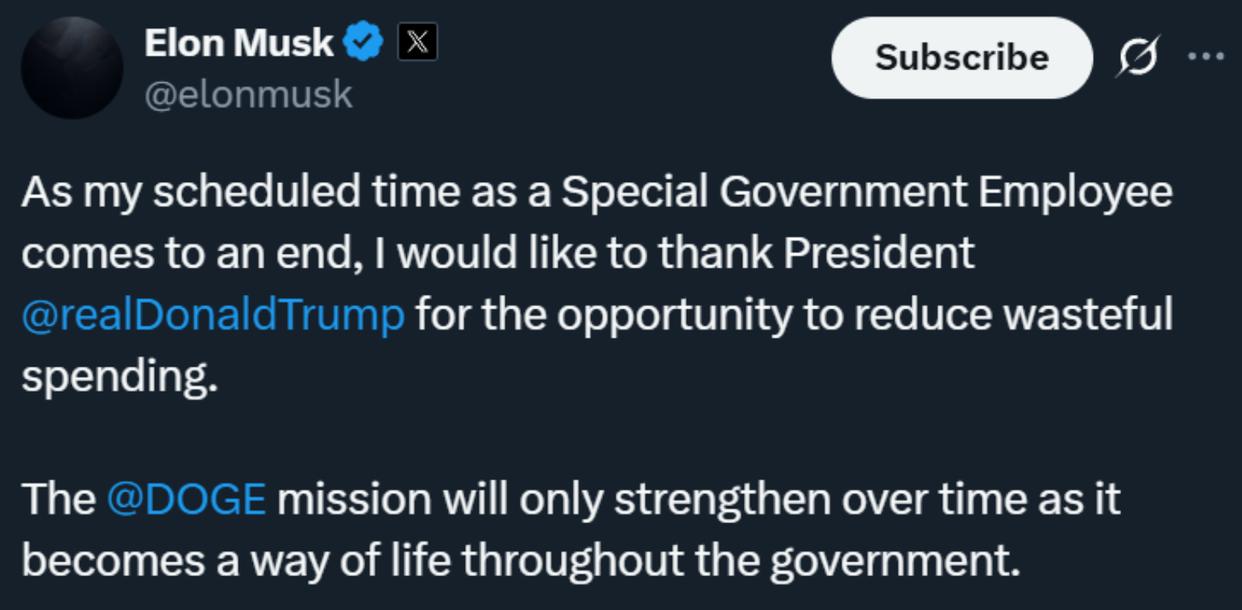

He said Tesla CEO Elon Musk’s commitment to the brand and Tesla’s Robotaxi service could redefine the company’s trajectory. He believes that the market has not yet fully realized Tesla’s potential in driverless driving and robotics.

On the other hand, Kathy Wood, founder of Ark Investment Management LLC, is known by the market as the “female stock god” of the United States (