There is no possibility of a win-win trade war. US President Trump aims to win the return of manufacturing to the United States by imposing tariffs globally. However, this goal is becoming increasingly difficult as China unexpectedly takes a tough stance. If the US continues to take a tough stance on the world, the US economy will be severely impacted; if it makes moderate concessions to other countries except China, it may ease economic pressure. China is also facing huge economic pressure, especially when it has not yet emerged from the deflation dilemma.

Many people speculate that Trump’s tariff remarks are just a means of negotiating pressure and will not be put into practice. However, on the first day of his inauguration, I published an article in Lianhe Zaobao titled “The United States and the World are Ushering in Dramatic Changes, and the Reality Will Be Seen in the Next Two Years” (Opinion Edition, January 22). At the beginning, I predicted: “We must prepare for major adjustments to trade rules and welcome the new order of international economic and trade rules.” As the United States imposed tariffs on the world, this prediction was verified. In this article, I will analyze in detail: What is the real purpose of the US tariff increase? And predict whether it can achieve the strategic goal?

The purpose of tariffs

Misunderstanding 1: The goal of tariffs is ideological. Many people believe that the tariffs are only aimed at China, and the tariffs on other countries are just smokescreens. Such rumors even caused a sharp market fluctuation: in the US stock market trading on Monday, there was news that Trump would suspend tariffs on countries other than China. This news triggered a sharp rise in the stock market, and the S&P 500 index soared 8% in half an hour. However, the White House immediately denied the news and the stock market quickly fell back.

I mentioned in my previous article: “(Trump’s) policy core is still dominated by the ‘economic account’, and the international community will be less stressed in the ideological field.” Since the 1980s, Trump has been complaining that international trade is unfair to the United States and advocating high tariffs on trade protectionism, although at that time he was mainly targeting Japan, not China. On the surface, China seems to be the main target because China is the world’s second largest economy and Sino-US trade is the world’s largest bilateral trade.

In March this year, Taiwan President Lai Ching-te proposed to work with global democratic partners to jointly develop a “non-red supply chain” that excludes red communist China. This move is obviously a misjudgment of the current situation. If someone thinks that Trump’s trade policy is ideological and only targets China, they are undoubtedly wrong. Even though Lai Ching-te proposed a non-red supply chain initiative and Taiwan’s TSMC promised to invest $100 billion in the United States, Taiwan was still not immune to tariffs and was still subject to a 32% tariff. In a subsequent speech, Lai Ching-te hoped to negotiate with the United States and proposed “starting with zero tariffs on both sides of Taiwan and the United States.” Perhaps he believed in the principle of tariff reciprocity mentioned by Trump, but this idea is obviously also biased.

Misconception 2: Tariffs are based on the principle of reciprocity. Trump has always emphasized that tariffs should be based on the principle of reciprocity. He claimed that the tariffs imposed on various countries are only “half-calculated” by various countries for the tariffs imposed on the United States. For example, he once said: “China’s tariffs on the United States are 67%, which includes currency manipulation and trade barriers… Our tariffs on China are 34% after discount.” However, China’s import tax rate is roughly around 15% to 25%, far lower than the 34% claimed by Trump. As for “currency manipulation” and “trade barriers”, these accusations lack objective standards and are more subjective judgments. The European Union, Vietnam and other countries have proposed the request of “zero tariffs on both sides”, but Trump refused without hesitation, claiming that it was far from enough. It seems that as long as a country has a trade surplus with the United States, it becomes a sign of “inequality”.

In fact, in Trump’s eyes, tariffs are an indispensable tool because they achieve two goals. First, the most important goal is to return manufacturing. In his speech on April 2, Trump said: “Today is ‘Liberation Day’. We have waited for this day for a long time. April 2, 2025, will always be remembered as the day of the rebirth of American industry.” Raising tariffs will increase the cost of imported goods and make domestic products more competitive in the market.

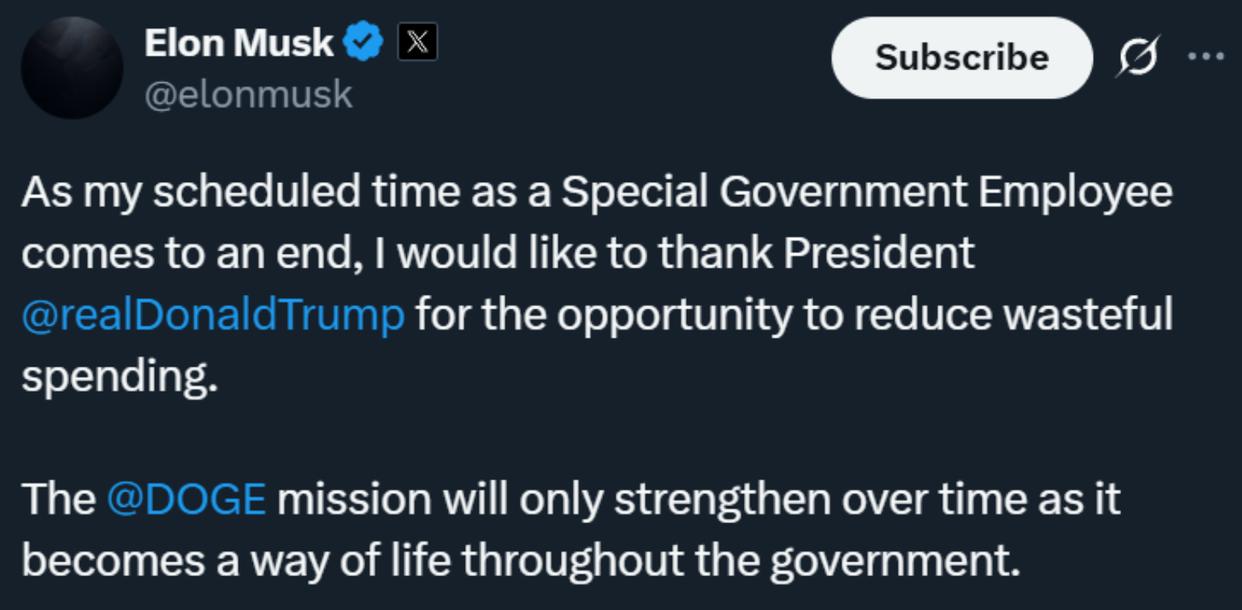

The second goal: to increase the fiscal revenue of the US government. The US government is actually facing a serious fiscal deficit problem, with the total national debt exceeding 36 trillion US dollars. Many investors and economic experts, including Buffett and Dalio, have warned that the current debt situation is unsustainable. In order to deal with this problem, the United States must adopt a policy of increasing revenue and reducing expenditure. In terms of cost-saving, government layoffs led by Musk are one of the measures; in terms of increasing revenue, Trump hopes to increase government revenue by imposing tariffs. He once said: “From 1789 to 1913, our country has always relied on tariff revenue, when the United States’ wealth was at its peak. There was so much wealth that even in the 1880s, the government set up a special committee to study how to deal with these huge taxes… But now we no longer face such troubles, but we will soon regain this situation.”

The actual war situation in the United States is not optimistic

Trump said: “For decades, our country has been plundered, robbed, invaded and looted by neighbors and distant countries, whether so-called friends or enemies… We can’t be like the past 50 years.” However, it is difficult to simply say that other countries’ trade surpluses have taken advantage of the United States, because American consumers and companies have benefited greatly from it.

According to statistics from the Wall Street Journal, in the past 50 years of globalization, the American middle class has achieved significant growth, the number of households with an annual income of $100,000 has tripled, and the number of households with an annual income of less than $35,000 has dropped by 25%. However, Trump obviously believes that the interests of American workers have been harmed and urgently needs more manufacturing jobs to return. Free trade should be a win-win situation, but tariffs are, as Buffett said, “to some extent equivalent to an act of war,” and war itself has never been a win-win situation. This also explains why other countries have a hard time negotiating with Trump.

The core purpose of Trump’s trade war is to make the United States win and win the return of American manufacturing. But the reality of the war is not optimistic. Trump’s global trade war has just started, and it has suffered a major setback due to China’s tough response. For the United States, the most ideal situation is that all countries in the world are afraid to succumb and let manufacturing return from all over the world. However, China unexpectedly showed a tough attitude. On April 2, after the United States announced a 34% tariff on China, China quickly retaliated and imposed the same tariff on the United States. Trump was extremely angry and announced on April 7 that if China did not withdraw its countermeasures within one day, it would further impose a 50% tariff on China. A few hours later, China responded clearly, “We will fight to the end.” It is not difficult to see from Trump’s mood that China’s response has a profound impact on his strategic layout.

However, China’s move is not without confidence. The proportion of China’s exports to the United States in total trade has dropped from about 20% during the first trade war in 2018 to about 11% at present. However, during this period, China’s overall exports have continued to grow. On the one hand, China’s foreign trade has become more diversified; on the other hand, China has bypassed the US tariff barriers through re-export trade. In addition, Morgan Stanley’s latest report pointed out that after the first Sino-US trade war, the global industrial chain has been reorganized, and further “de-Sinicization” has become very difficult, because a considerable part of China’s exports to the United States are “capital goods”, that is, raw materials and equipment needed for domestic production in the United States.

The US global trade war is destined to put the United States in a dilemma because of the comprehensive escalation of the Sino-US front. If it continues to take a tough stance on the world, the US economy will be severely impacted; if it makes moderate concessions to other countries except China, it may ease economic pressure, but such a trade-off will weaken Trump’s grand plan to bring manufacturing back to the United States. Companies will choose to produce in these countries instead of returning to the United States, and allow China to continue to rely on re-export trade through other countries. China is also facing huge economic pressure, especially when it has not yet emerged from the deflation dilemma.

China chose not to compromise not because it has suffered less impact than the United States. China may be betting that it can be more “tolerant”. It depends on whether the American people are willing to endure with Trump and the reshaping of the political landscape after the 2026 US mid-term elections. Therefore, I once said: “The United States and the world are ushering in dramatic changes, and the truth will be revealed in the next two years.”