On March 11, Tesla’s stock price suffered a sharp drop in Eastern Time, falling more than 15% to close at $222.15, the largest single-day drop since September 2020. The plunge caused the company’s market value to evaporate by about $130 billion overnight.

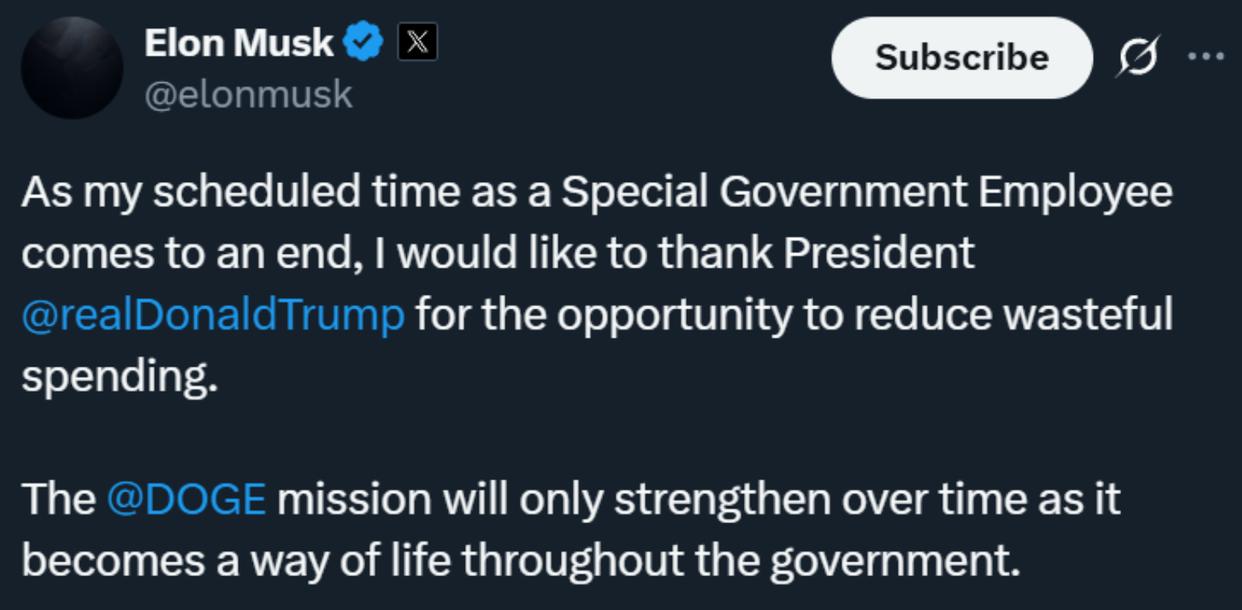

Faced with market volatility, Tesla CEO Musk responded to a report on the company’s largest single-day drop in history on social media, saying: “In the long run, everything will be fine.” As of March 10, 2025, Tesla’s stock price has fallen by more than 50% from its historical high, and its market value has shrunk by more than $800 billion.

Analysts believe that the main reason for the sharp drop in stock prices is the recent weak delivery data and the multiple challenges faced by the company in the global market. According to data released by relevant institutions, Tesla’s wholesale sales in the Chinese market in February fell significantly, down 49% year-on-year to only 30,688 vehicles, a new low in two and a half years.

In addition, Tesla’s performance in other major markets around the world is also unsatisfactory. In the European market, the company’s new car sales in January fell 45% year-on-year, while sales in Germany in February plummeted 76.3%, with only 1,429 vehicles sold. Previously, Musk had admitted that the current business operation is facing a “very difficult” situation.

Due to sluggish sales and weak market demand, several investment banks have successively lowered Tesla’s target price and performance expectations. A well-known analyst adjusted Tesla’s first-quarter and full-year performance expectations, predicting that deliveries this quarter will be 367,000 vehicles, a 16% drop from the previous forecast.

An international bank lowered Tesla’s target price from $490 to $380, citing reasons including a decline in new car sales and the delay in the latest progress of low-cost models. Another investment bank also lowered Tesla’s target share price from $345 to $320. In addition to the decline in sales, analysts also pointed out that Tesla is facing fierce competition in the field of autonomous driving technology in the Chinese market.