In the next two weeks, the recently hit British market may face a new wave of shocks. This week, the Bank of England may release its most hawkish statement since September last year, as policymakers have recently begun to worry about the resurgence of inflation in the UK. At the same time, the dilemma of the UK’s finances may make the market worse.

The dilemma of the UK’s finances: high deficits and economic stalling

The UK’s public finances, which are strained by growing debt and slow economic growth, will face a key test this month. Investors say the test may bring another market shock to the UK economy, which is increasingly dependent on volatile foreign funds. British Chancellor of the Exchequer Rachel Reeves will release the latest public finances on March 26 based on the assessment report of the Office for Budget Responsibility (OBR), the UK’s fiscal watchdog.

Reeves said her fiscal rules, which are designed to balance daily spending and revenue and reduce the proportion of public sector net financial liabilities to the economy in the coming years, are non-negotiable. But investors worry that the UK may fall into a painful trap that implementing these rules by cutting spending or raising taxes will undermine the investment needed to improve long-term economic growth.

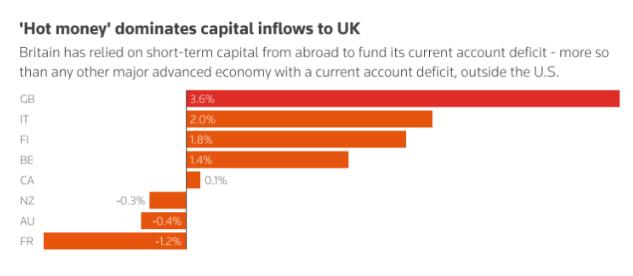

Among advanced economies, Britain’s current account deficit is second only to the United States. Capital flows from the rest of the world are increasingly in the form of short-term funding rather than stickier forms of capital such as direct investment. Data show that Britain is more dependent on short-term capital than other major advanced economies with similar current account deficits. Short-term capital can be easily withdrawn in a sell-off.

Kamal Sharma, a strategist at Bank of America, said Reeves’ fiscal rules could become a target for traders, similar to the currency pegs during the Asian financial crisis in the late 1990s.

Sharma explained: “A big question for many countries is how to grow the economy to the point where debt can be reduced? Right now, the UK is certainly ahead of the curve on this question. As the Asian financial crisis and more recent turmoil in the UK and France showed, markets tend to prefer some form of nominal anchor – whether it’s a fixed exchange rate or a fiscal rule.”

The UK economy grew by just 0.1% in the fourth quarter of 2024, with economic output unexpectedly falling in January. The Bank of England halved its growth forecast for 2025 to 0.75% last month. “The UK economy seems to have lost its ability to grow,” said former Bank of England policymaker Willem Buiter. “The reason people are worried about the UK budget is that the prospect of generating more revenue is extremely slim, given the tax rate.”

Fragile UK Markets

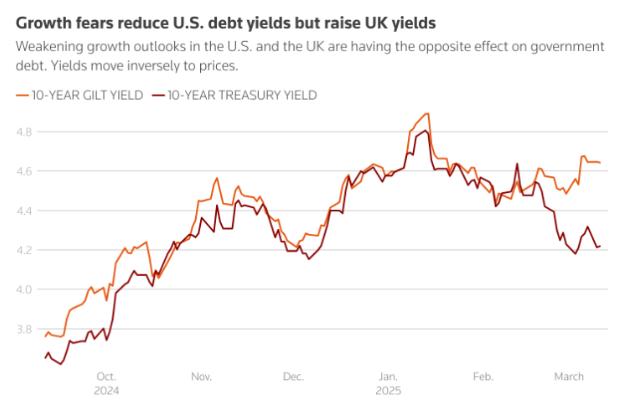

In January, when global markets were concerned about US President Trump’s tariff plans, a sharp sell-off in UK government bonds and the pound highlighted the fragility of the UK market. A surge in German government borrowing costs last week also drove UK gilt yields higher. Lipper data showed outflows from UK equity funds hit their highest level in eight months in February, while the FTSE 250 index, which focuses on the UK domestic market, has fallen about 5% since the end of January.

By contrast, while US Treasury prices have risen from a month ago as Trump’s policy plans have raised concerns about economic growth, UK gilts, which are usually closely correlated with US Treasuries, have sold off.

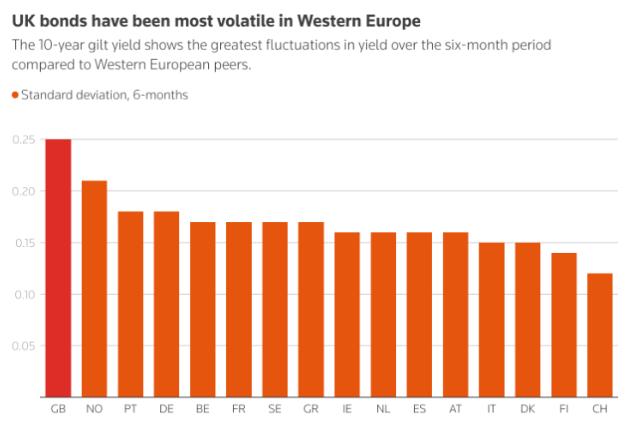

The Brexit turmoil and the 2022 “interim budget” under former Prime Minister Liz Truss once led investors to compare the UK with emerging markets. Current Prime Minister Keir Starmer and Reeves promised to restore stability before the July 2024 general election. But over the past six months, the volatility of 10-year UK gilt yields (measured by standard deviation) has also been higher than other similar Western European bonds.

Asked if she was concerned about the negative market reaction to her March 26 statement, Reeves said she would not make running comments about preparations.

“We took the necessary actions in October to ensure the safety of the public finances,” Reeves told the media on the sidelines of the recent G20 summit in South Africa, referring to the Labour government’s first budget. She said she would take action if necessary to meet her budget rules.

BNP Paribas said the market may view the extreme actions on March 26 as a panic. Reeves is likely to promise spending cuts in the near future and may even take tax measures later in parliament.

“Ultimately, we think the government will take a combination of measures and will not react too quickly to market pressures or put all its eggs in one basket,” said Dani Stoilova, an analyst at BNP Paribas.

Van Luu, head of foreign exchange and fixed income strategy at Russell Investments, said the pound and government bonds will respond better to spending cuts than to tax increases. “What the government does is ultimately a political choice, but market participants certainly prefer spending cuts,” he said.

Liam O’Donnell, fixed income manager at Artemis, said that at current yields, British gilts are not unattractive. “But the most important swing factor is the lack of fiscal space available to a Labour government,” he said.

To make matters worse: Bank of England worries about rising inflation

While Britain’s fiscal situation has brought uncertainty to the economy and markets, Bank of England policymakers are beginning to worry about rising price pressures. Officials will weigh inflation warnings against the sluggish British economy, which shrank in January, and rising geopolitical tensions.

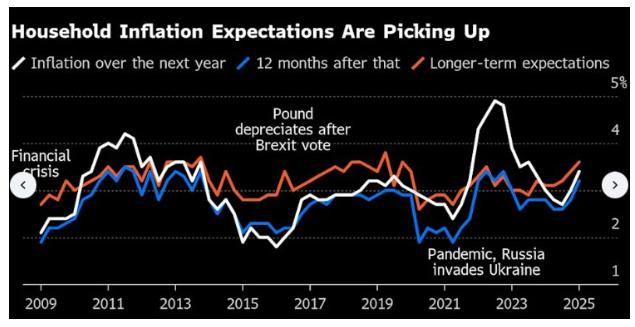

Although inflation is driven by what Bank of England Governor Bailey called “transitory factors,” mainly energy and food; but because the Bank of England expects price increases to peak at 3.7% this year, he and other officials do not rule out the possibility of a second-round impact on wages and prices. Data released last week showed a sharp rise in British inflation expectations, highlighting the above risks.

“Most policymakers appear happy to stick with quarterly rate cuts, as a combination of rising inflation and increased geopolitical uncertainty weighs,” said Bloomberg Economics economists Dan Hanson and Ana Andrade.

Against this backdrop, the Bank of England’s Monetary Policy Committee will have to wait until its May meeting to discuss the impact of measures taken by Chancellor of the Exchequer Rachel Reeves on March 26 to protect fiscal rules. The Bank of England is likely to keep interest rates unchanged on Thursday and stick to its position that future rate changes will only be gradual.

All 61 economists polled by Reuters last week expected the Bank of England to keep its base rate unchanged at 4.5%, with the next rate cut likely in May, followed by further cuts in August and November.

The Reuters poll showed that among the members of the Monetary Policy Committee, a 7-2 vote was expected to support keeping interest rates unchanged. In February, seven members of the Monetary Policy Committee supported a 25 basis point cut, while two members opted for a larger 50 basis point cut.

Investors will be watching closely for any changes in the views of the MPC members, some of whom are more concerned than others about the risk of persistent inflation. If inflation risks continue to force the Bank of England to keep interest rates high, this in turn will increase interest payments on the UK government’s debt, which may force the government to further aggressively cut spending and increase taxes, which will put pressure on the economy.

Just weeks before Thursday’s vote, the MPC cut interest rates by 25 basis points, and hawkish official Catherine Mann supported a sharp 50 basis point cut. Traders responded by fully pricing in another rate cut in May. They have now reduced the chance of that to 70%, and expect only two more cuts this year.

Recent comments from some dovish figures suggest a shift in policy since the MPC cut its base rate for the third time since August last year at the beginning of last month. Two rate setters who supported rate cuts at the first three meetings – Deputy Governor Dave Ramsden and external appointee Alan Taylor – seemed to waver in recent appearances. Meanwhile, while Mann made the case for a big rate cut last month, he also stressed the need to keep policy restrained.

Ramsden, seen as a weathervane for the MPC, abandoned his dovish bias and returned to a middle ground in a speech in South Africa. He said he was “less certain” about the outlook for the jobs market and was influenced by the Bank of England’s forecast for a sharp rise in wages. Taylor has also turned more cautious, telling MPs earlier this month that his certainty about the inflation outlook “has declined significantly”. His testimony showed he sees risks ahead as more two-sided.

In New Zealand, Mann said she voted for a 50 basis point rate cut to send a signal to financial markets distracted by events in the United States, but warned that wage and price data were “not yet consistent with target”.

Andrew Goodwin, chief UK economist at Oxford Economics, said: “The pace of rate cuts is well established and renewed concerns about weak supply mean it is unlikely that there will be more than two or three votes in favour of successive rate cuts. The only real question is whether Taylor will vote for a rate cut.”

One factor the Bank of England is watching closely is the impact of a 26 billion pound ($33.6 billion) payroll tax hike for employers that will take effect in April. A survey of 1,520 executives by Boston Consulting Group found that only 15% of businesses plan to cut jobs in response to the tax increase. Many companies are reluctant to lay off employees because they worry they won’t be able to find the right people if demand picks up. Instead, they are cutting non-essential costs in areas such as real estate or supply chain management, or limiting hiring.

“Overall, businesses are still more likely to grow than cut jobs, suggesting there is still plenty of demand in the economy. Economic growth could be as good as last year,” said Raoul Ruparel, director of Boston Consulting Group’s Growth Center.