U.S. Treasury Secretary Benson said on Sunday (March 16) that the Trump administration is focused on preventing a financial crisis that could be the result of massive government spending over the past few years.

“What I can guarantee is that we will have a financial crisis. I’ve studied it, I’ve taught it, and if we keep spending at this level, everything is unsustainable. We’re resetting, and we’re putting things on a sustainable path.”

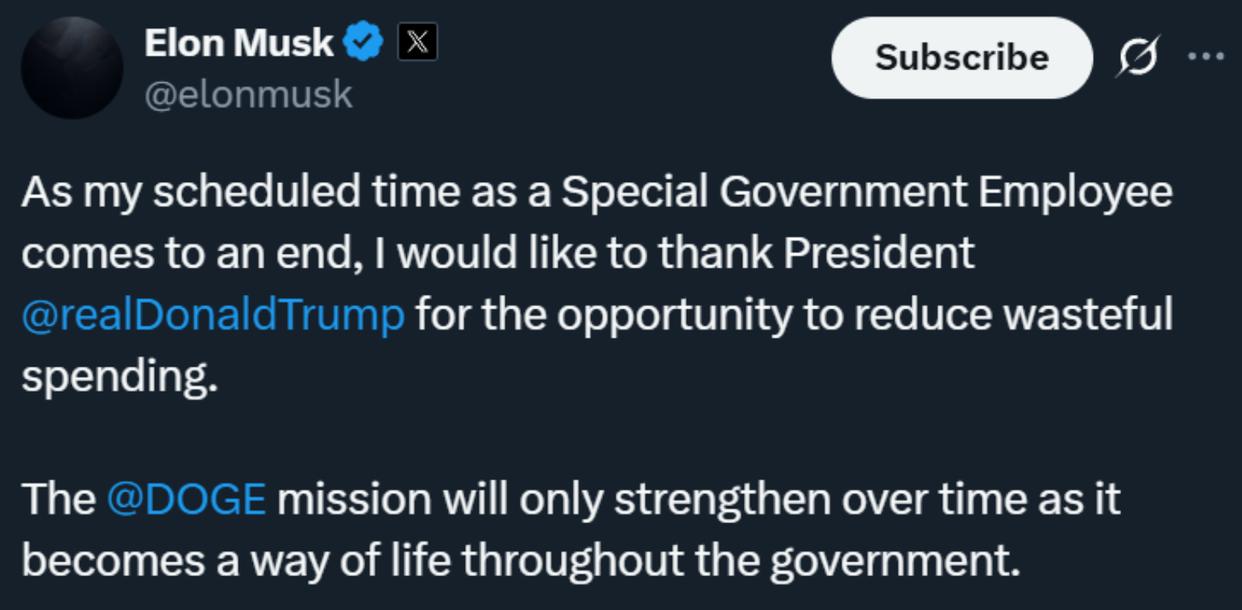

President Trump has made it a priority to clean up government finances since taking office. He created the so-called Department of Government Efficiency (DOGE), led by Musk, to take the lead in layoffs and early retirement incentives across multiple federal agencies.

Nevertheless, the U.S. debt and deficit problems worsened in Trump’s first month in office, with the budget gap exceeding the $1 trillion mark in February.

Bessant noted that there is “no guarantee” that there will not be a recession. Markets have been turbulent recently as Trump’s broad tariffs have raised concerns about inflation and a slowing economy. The S&P 500 fell 10% from its February high last Thursday due to increased volatility. Bessant believes that the current correction the market is in is benign and that Trump’s pro-business policies will boost the market and the economy in the long run.

“I’ve been in the investment industry for 35 years, and I can tell you that corrections are healthy, they’re normal. What’s unhealthy is that you see these markets that are directly extremely excited, and that causes financial crises. If someone had put the brakes on earlier, it would have been much better and we wouldn’t have had these problems.”

He added: “I’m not worried about the market. In the long run, if we have good tax policies, deregulation and energy security, the market will do a lot. I mean, one week is not the market.”